News

News

Industrial Technology Report

Bowen has released its Industrial Technology Report focused on the state of fundraising and M&A in H1 2023. The report leverages Bowen’s industry expertise and in-depth capital market knowledge to analyze the current state of M&A and fundraising in the Industrial Technology Market.

Although off 2021 record highs, we expect the M&A and funding environment to finish strong in 2023

- The macro factors that drive funding and M&A for industrial technology companies have not abated

- Strategic buyers, VCs, and private equity firms remain flush with cash

- Bowen’s 1H 2023 closed deals and checks with investors and strategics indicate that quality companies continue to attract interest

- Focus has shifted (back) to more traditional factors when evaluating investments and acquisitions

- Growth and revenue scale – proxies for a company’s long-term prospects & market demand for its products

- Profitability and cash efficiency – proxies for building sustainable companies and management discipline

- Industrial logic – clear rationale that can be modeled into buyer’s return on investment framework

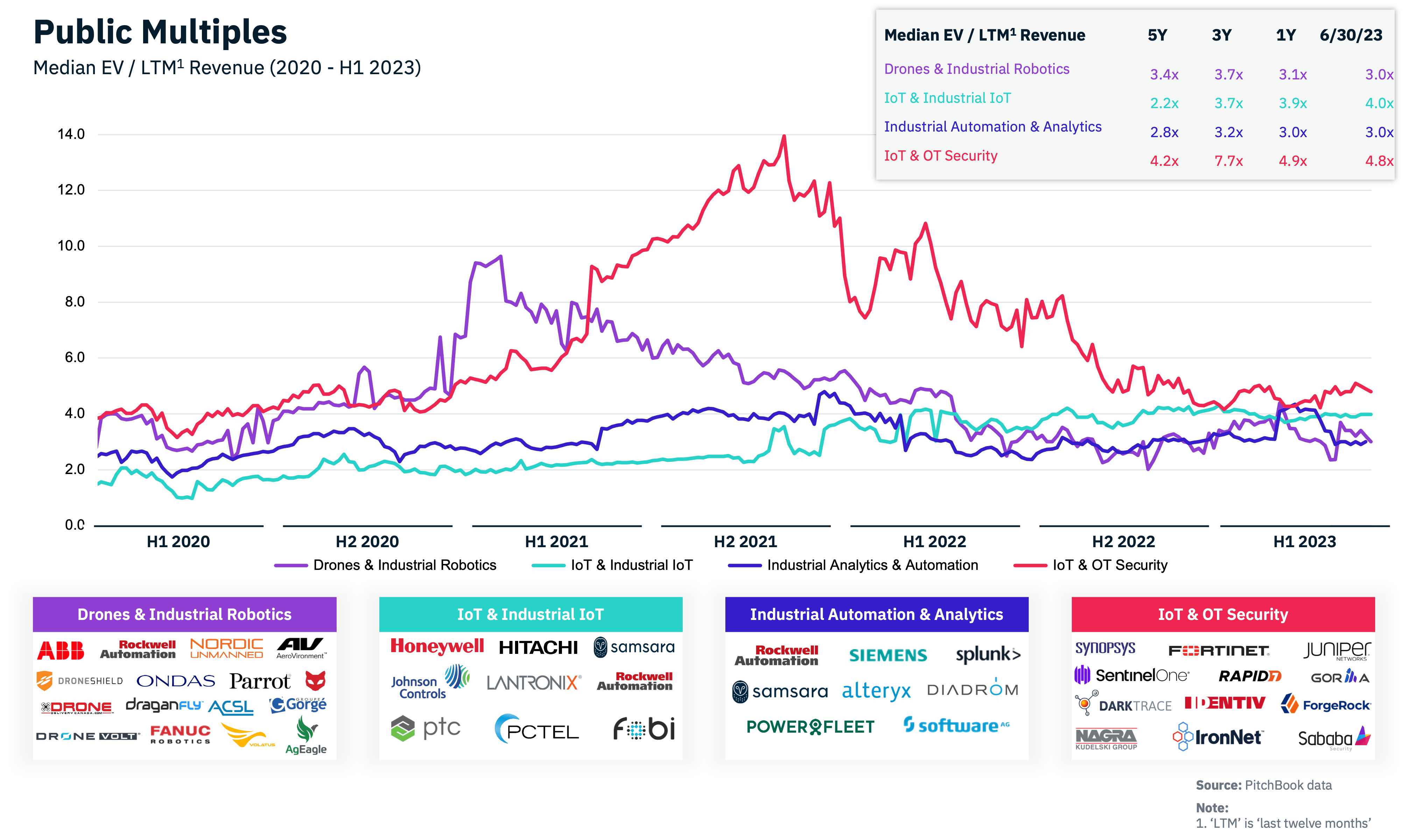

Overall, Valuations Remain Strong

- Putting aside what increasingly appears to have been a bubble in 2021, valuations are above historical norms

- Our recent transactions and market checks indicate EV / revenue multiples are 1 – 2 turns below the highs of 2021, but by no means are “off a cliff”

- Public market multiples are a better proxy currently than recent M&A and funding comparables

- 2023 deal activity is likely to look more like a barbell than in the last two years

- Interest and money likely will flow towards companies that are hitting market adoption, growth & profitability progress metrics

- Companies with lower growth, <$5M revenue and burn rates >1m per month will have a harder time raising money or exiting at premium valuations in the near term

- In all cases, management and boards should carefully consider cash burn, focusing on the highest returning investments in customer acquisition and R&D

In addition to our 2023 M&A and Fundraising Outlook, the full report offers:

- Top Trends and Opportunities

- Market Snapshots

- IoT & Industrial IoT

- Drones & Industrial Robotics

- Industrial Analytics & Automation

- IoT & OT Security

- Top Investors and Strategic Acquirers

- Notable M&A Transactions

Download the full report

Learn more about our Industrial practice