News

News

FTFL - Who Wins in 2024? Wall Street Whispers

We are in the midst of the 2024 Prediction Season. UBS forecasts a soft landing recession in 2Q24, JPMorgan forecasts an 8% drop in the S&P 500, and Goldman Sachs predicts Fed rate cuts in 4Q24.

We try hard to not make predictions, rather we prefer to analyze actual data to bring pattern recognition into focus. We are particularly proud of FTFL pieces examining the bottom of the VC market and the Fed’s hidden trick, which was borne out by capex driving Q3 GDP growth above expectations.

With the 2024 US presidential election cycle ramping up, we are preparing in the only way we know how: by studying the data. This month, we take a closer look at the relationship between presidential election cycles and financial markets, challenging conventional wisdom about how they influence each other.

Fact or Fiction?

1) The stock market can predict the outcome of the election.

Fact. S&P 500 performance leading up to the election is an excellent indicator of who will win – it turns out Wall Street does whisper. In 9 of the last 10 presidential elections, any rise in the S&P 500 over the 3 months leading up to election day has meant the incumbent party will win, while any drop has meant the challenging party will win.

2) The stock market reacts favorably to Republican victories and the implications of business-friendly policies to come.

Fact?

Actually, Fiction. While Republican victories do commonly result in a stock market bump, it turns out that Democrat victories often do the same. Excluding the widespread downturns of 2000 and 2008, it appears that most presidential elections result in a near-term stock market increase. And when we look a year out from election day, Democrat victors see a median increase of 10%, vs. 2% for Republican victors.

3) The Fed will sit on interest rate changes during presidential election cycles. The Fed likes to be apolitical and does not want its decisions to influence voters, so we should see fewer rate changes during election years.

Fact? It may be the law of small numbers, but there is a material difference. If we exclude the unprecedented actions of 2008, when the Fed dropped the rate to zero, the median number of annual rate changes drops 33% from 3 in non-election years to 2 in election years. Interestingly, 67% of Fed interest rate changes have been in 25 basis point increments, while the vast majority of 50+ basis point changes have been during periods of crisis response (Tech bubble crash in 2000, Great Recession in 2008, Covid shutdown in 2020, Inflation reduction in 2022). It appears that unless its hand is forced, the Fed will slow down on changes during election years.

4) Election year uncertainty causes companies to sit on investments. If this is true, we should expect to see a capex dip in election years if companies decide to push spending to non-election years.

Fiction. With the exception of the 2008 Great Recession and recovery, US capex as a percent of GDP has stayed within a 28%-33% range, with no meaningful difference during election years. It appears that election years are just business as usual for US companies.

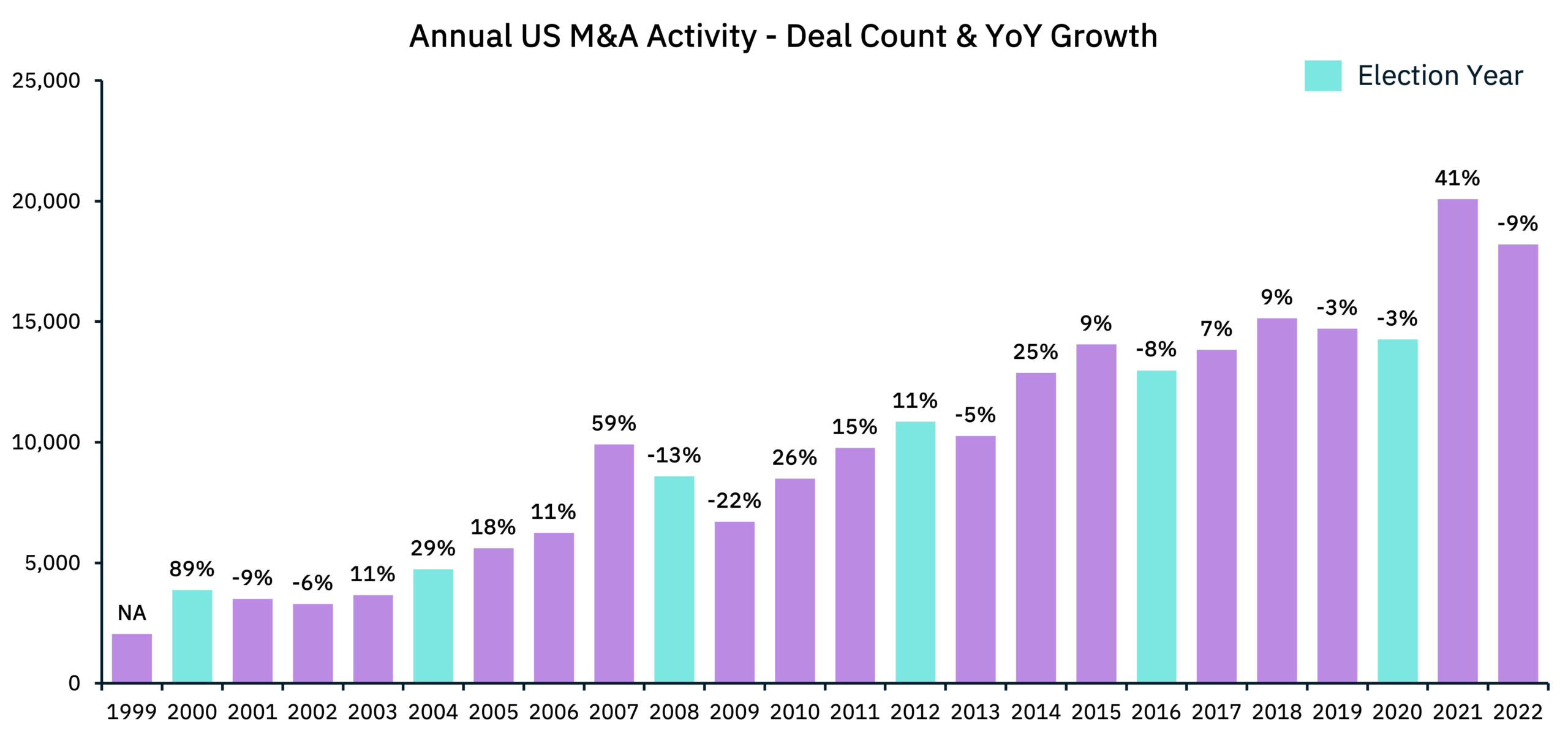

5) Election year uncertainty will slow down transaction activity. Since transaction activity has steadily risen over the last 20+ years, we might see slower growth in election years.

Fiction. We looked at this every which way, trying to prove the common belief that election years are bad for dealmaking – M&A deal counts, M&A deal values, VC deal counts, VC deal values, tech only, first 3 quarters only… we found nothing. Year-to-year changes can fluctuate wildly, and the instances of election year slowness coincide with massive broader economic events (Great Recession in 2008, Covid shutdown in 2020), making it impossible to solely blame elections for any deal slowdowns.

The results of our presidential election cycle analysis surprised us. As career investment bankers are now entering our 7th POTUS election, the data – particularly as it relates to dealmaking – seems to fly in the face of conventional “slowdown” wisdom. Upon closer examination, it would seem the eternal words of James Carville sum up presidential election cycles the best: “It’s the economy, stupid.”

This article appeared in our December 2023 issue of From the Front Lines, Bowen’s roundup of news and trends that educate, inspire and entertain us. Click here to subscribe.