News

News

FTFL - Unicornucopia

Do we have a Unicorn obsession at Bowen? We prefer to think of it as a liquidity obsession. In theory, these ~1,500 Unicorns sit at the top of the private company liquidity food chain and should be among the first players to test the exit waters.

Back in January 2023, we analyzed the Unicorn Megaround Bubble of 2021, a year that saw the number of Unicorn Megarounds at > 2x than any other year, with over 100 companies raising $500M+ rounds at $1B+ valuations. For this month’s FTFL, we wondered, what has happened to those 100 Unicorns now 3 years since achieving their exalted status?

Trendlines – The Class of 2021… Looking Like 5th-Year Seniors?

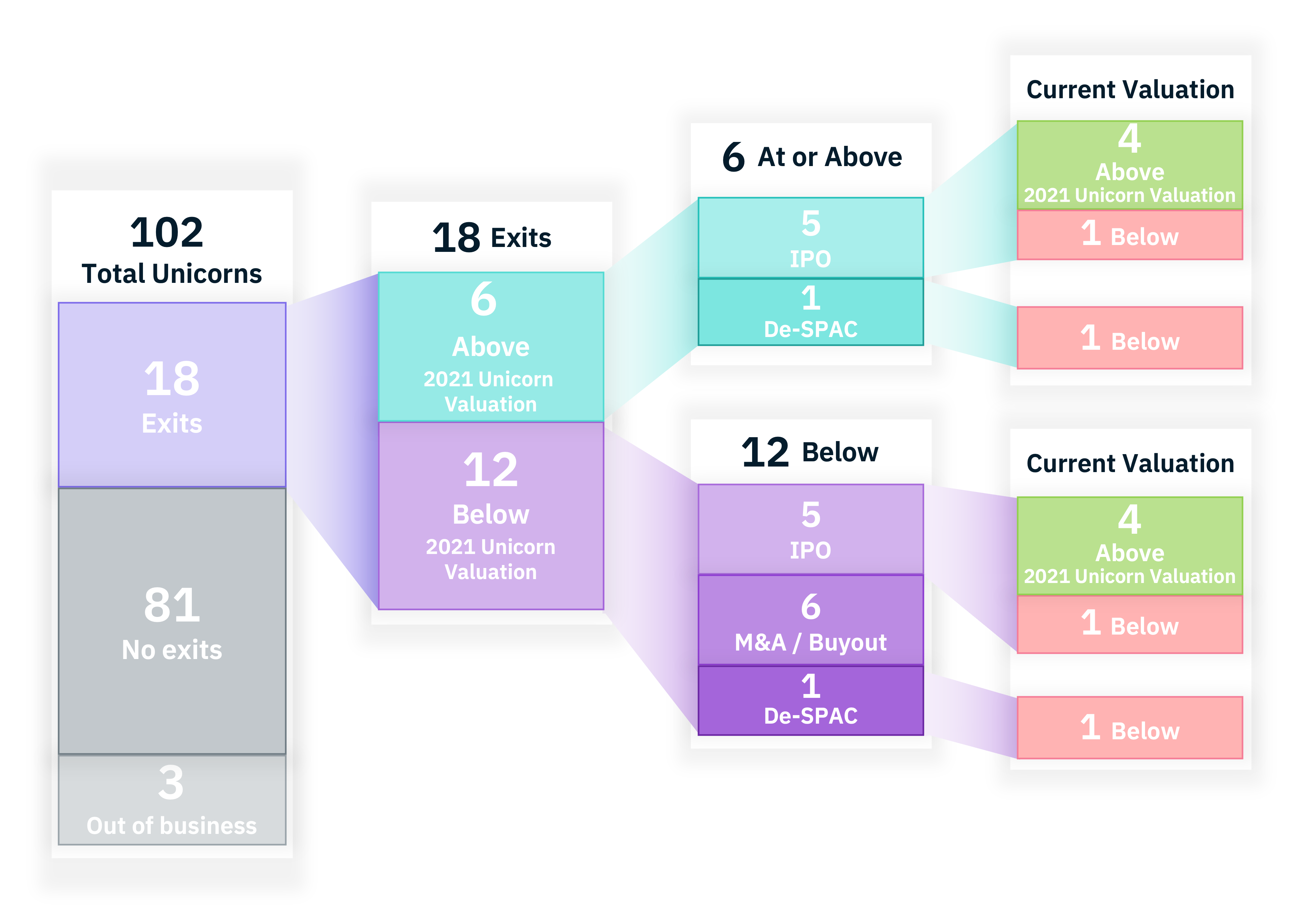

Of the 2021 Unicorn class, only 18% have exited, compared to 48% and 36% from the 2019 and 2020 cohorts, respectively. With each passing year, we of course expect “seasoning” to increase the exit rate – but if we look into our crystal ball, will the Class of 2021 reach 36% next year and 48% in two years? (We explore that further. Keep reading…)

How did these exiting 2021 Unicorns fare with respect to valuation? Let’s dig in further.

It has long been our hypothesis that the only rational outcome of the 2021 Unicorn Bubble is for a material portion of these companies to have underwater exits. 12 of the 18 exits were at valuations below their 2021 private funding round, at a median drop of 41%.

But fear not! The public markets have a way of getting to a company’s “real” valuation. Of the 5 IPOs below Unicorn valuations, 4 have recovered to currently trade at a premium to their 2021 Unicorn valuations. And of the 10 total IPOs, 8 are now trading above their Unicorn valuations. Perhaps the seemingly irrational Unicorn exuberance of 2021 was not so irrational after all. The system is working.

When we looked at the 6 companies that exited above their 2021 Unicorn valuation (at a median premium of 66%), one statistic really stood out to us – 5 of the 6 premium exits were IPOs, and the other was a de-SPAC – not a single premium exit via M&A.

Do we have enough buyers big enough to make such acquisitions? Well, it matters a little less than you think. Of all VC-backed exits since 2018, 87% were via M&A. But for Unicorns only, that number shrinks to 46%. And for Unicorns exiting above $25 billion, that falls further to 38%, with 62% going public via IPO or de-SPAC.

So what does this all mean for the backlog of 81 Unicorns from 2021 that are still private? 40 of the 81 have had to raise another material round of funding, but only 10 of these raises have been down rounds. And only 4 of these 40 rounds have been insider-only, meaning most of these companies have been able to attract new investors. Perhaps this is a largely healthy group, just being patient and biding their time.

But if they are waiting for their IPO timing to optimize, or for the Magnificent 7 to become interested in acquiring them, there’s another group that may jump the line. Notice in our first graph that 2024 Unicorn rounds are back on the upswing? Take a guess as to what 2 letters are behind this rise…

Will those 2021 Unicorns in the exit queue have to wait for the winners and losers to be determined from the current AI Unicorn spree? Time for a good old-fashioned Unicorn Showdown.

While AI Unicorns are clearly less mature than the Class of 2021, my goodness have they caught up quickly in the all-important total capital raised metric.

At Bowen, we know firsthand that in 2024 every major tech acquirer cleared the strategic decks and is now poised to make needle-moving acquisitions to build out their AI portfolios. In this sense, the Class of 2024’s youth, vigor and AI focus put them squarely in Big Tech’s crosshairs.

Is there still time for the Class of 2021 to change their websites to .ai or will they become forever known as the Forgotten Unicorns?

This article appeared in our November 2024 issue of From the Front Lines, Bowen’s roundup of news and trends that educate, inspire and entertain us. Click here to subscribe.